HealthTech isn’t coming—it’s already here

Digital health is no longer experimental—it’s expected. From AI diagnostics to remote patient monitoring, the HealthTech industry is reshaping how care is delivered, paid for, and experienced. For Boards and CEOs, this is not a peripheral trend. It’s a core shift.

This shift brings opportunity, but also pressure. Growth-stage HealthTech companies must scale while navigating regulatory complexity. Legacy providers must digitize without losing trust. And private equity investors need seasoned executives who can lead innovation without sacrificing operational rigor.

These challenges—succession planning, recruiting visionary CXOs, and aligning leadership with market shifts—are why Executive Search is now a cornerstone of HealthTech strategy.

The future of healthcare won’t be determined by technology alone. It will be led by the CEOs, Chairpersons, and Boards who understand how to deploy it—and by the recruiters who help them find those leaders first.

Why HealthTech Matters for Boards, CEOs, and Investors?

Global HealthTech investment is booming, with market size expected to reach over $900 billion by 2032. But unlike past cycles of healthcare innovation, the current wave is fundamentally reshaping leadership needs at the top.

Today’s CEOs must balance clinical credibility with digital fluency. Boards need to manage risk while pushing innovation. Chairpersons are expected to bring not just governance expertise—but insight into tech-driven care models.

For institutional investors, this means leadership decisions can’t be delayed until after product-market fit. They must begin with it. Without the right CEO or CXO, even the most promising MedTech or HealthTech product won’t cross the commercialization chasm.

According to NextGen’s blog on Scaling MedTech Leadership, “The most successful medical device companies don’t just attract capital—they attract leaders who know how to use it.” Investors now measure value by the strength of the executive bench as much as by the pipeline.

Boards that want to remain competitive in this rapidly changing landscape are engaging executive recruiters early, building succession strategies tailored for AI, robotics, and virtual care, and ensuring that cultural fit doesn’t get lost in the race for innovation.

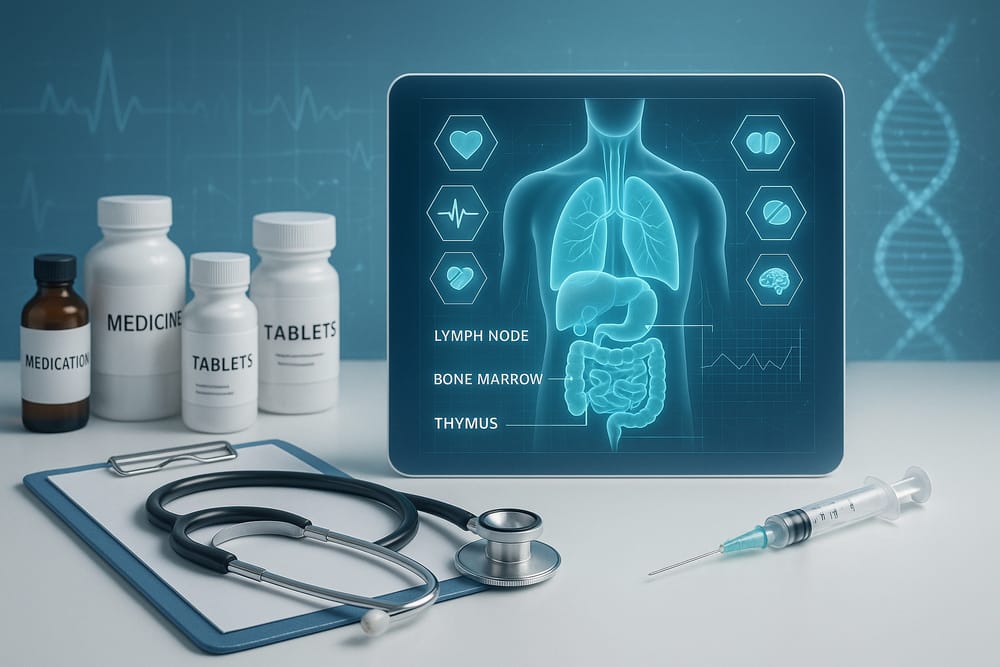

The Shift To Predictive And Personalized Care

We’re moving from reactive to proactive healthcare. Predictive analytics, wearable sensors, digital biomarkers, and genomics are all fueling a new model of hyper-personalized medicine. The implications for talent acquisition are significant.

As HealthTech evolves toward real-time diagnostics and preventive models, CXOs must adapt. Product leaders are now expected to integrate machine learning. Clinical affairs leaders must navigate FDA frameworks for software-as-a-medical-device. Even finance executives must understand reimbursement models that didn’t exist five years ago.

The result? Traditional candidate pools aren’t enough. Leadership roles now demand hybrid skill sets that span healthcare, data science, and SaaS business models.

Executive Search firms with vertical specialization are best positioned to fill these gaps. They understand the nuance of recruiting a CXO who can lead a digital therapeutic through clinical trials while also scaling a platform across global payer systems.

Talent must match technology. And the companies that hire for where the industry is going—not where it’s been—are the ones that will dominate the future of care.

AI, Automation, and the New CXO Mandate

Artificial intelligence isn’t just disrupting healthcare—it’s redefining what leadership in HealthTech looks like. Clinical AI tools, virtual assistants, and automation platforms are rapidly shifting the operational backbone of care delivery.

This evolution demands a new generation of CXOs.

Chief Operating Officers must now manage human-machine workflows across decentralized teams. Chief Commercial Officers are expected to bring AI-powered CRM insight into go-to-market execution. And perhaps most importantly, CEOs must be comfortable steering companies where algorithms—not physicians—make the first diagnosis.

This level of disruption requires more than technical knowledge. It calls for adaptability, ethical leadership, and fluency in change management.

Retained recruiters are increasingly tasked with identifying leaders who’ve successfully scaled digital health products in AI-first environments. They must assess not only experience but mindset—resilience, agility, and the capacity to guide both clinicians and engineers through transformation.

As discussed in “Learning from Cybersecurity Failures: Best Practices”, digital innovation without governance can expose organizations to risk. The same applies to HealthTech. The new CXO must innovate securely, scale responsibly, and lead with insight.

How Executive Search Drives Innovation In HealthTech

Innovation requires alignment—between vision, execution, and leadership. Executive Search is no longer a support function; it’s a critical lever for accelerating HealthTech success. Recruiters don’t just source candidates. They architect leadership.

Retained executive search firms offer more than access to top-tier candidates. They bring sector-specific intelligence, map competitive leadership moves, and align succession strategies with evolving market needs. More importantly, they understand what HealthTech demands at every stage—whether it’s clinical validation, regulatory strategy, or global commercialization.

In high-growth HealthTech startups, a mis-hire at the CXO level can stall funding, delay product launches, or alienate strategic partners. The right recruiter prevents that by screening for functional capability, leadership style, and cultural compatibility. These aren’t just boxes to tick—they’re success indicators.

In NextGen’s “Strategic Talent Pipelines in Emerging Tech” article, the firm outlines how building future-ready pipelines—before a vacancy occurs—enables growth-stage and PE-backed companies to hire faster, retain longer, and outperform competitors in mission-critical transitions.

If you’re not investing in an executive search partner that understands HealthTech, you may be hiring for yesterday’s challenges instead of tomorrow’s breakthroughs.

Succession Strategies In An Evolving Care Ecosystem

The HealthTech sector has seen record CEO turnover over the past five years. As companies scale and investor expectations rise, succession planning can no longer be postponed. The Chairperson’s responsibility isn’t just to govern—it’s to ensure continuity.

Yet many growth-stage companies have no formal succession strategy in place. This creates gaps during executive transitions, delays in strategy execution, and loss of market confidence.

Succession, in a HealthTech context, must be viewed through the lens of adaptability. Today’s CEO may have guided the company through clinical trials, but the next may need to lead IPO prep, payer negotiations, or M&A integration.

That’s where succession-focused recruiting becomes invaluable. By maintaining an ongoing relationship with a retained executive search firm, companies gain visibility into emerging leadership that matches future needs—not just current roles.

As noted in “Building a Resilient Business in a Rapidly Changing Market”, resilient organizations are built on proactive strategy, not reactive decision-making. And few decisions are more consequential than who leads next.

Talent Shortages, Regulatory Hurdles, And What Recruiters Must Solve

HealthTech recruiting doesn’t happen in a vacuum. It’s shaped by macroeconomic forces, talent shortages, and an ever-tightening regulatory environment.

There is fierce competition for product, clinical, and commercial leaders who understand FDA processes, value-based care models, and international expansion. At the same time, many traditional healthcare leaders struggle to translate their expertise into digital-first environments.

This disconnect creates a vacuum that only strategic recruiters can fill. They must educate Boards on emerging leadership profiles, coach candidates on startup dynamics, and balance innovation with compliance expertise.

Further, with tightening data privacy laws and AI regulations on the rise, recruiters must now evaluate how well CXO candidates navigate governance, cybersecurity, and ethical deployment of patient data. These aren’t future issues—they are present-day obstacles that impact growth.

Retained search partners who specialize in HealthTech are uniquely equipped to bridge these gaps, because they’re tracking the evolving skills matrix in real time and adjusting their search strategies accordingly.

The Board’s Role In Accelerating Healthtech Transformation

HealthTech innovation begins with leadership—but it is scaled through governance. Boards that merely “advise” without strategically shaping talent are missing the point. In fast-growth sectors, Board members are talent accelerators.

Chairpersons must lead the charge in defining the leadership attributes required for next-phase growth—whether it’s digital agility, global expansion experience, or deep payer knowledge. They must ensure the executive team has both depth and diversity in thought and experience.

The Board also plays a crucial role in championing succession. Not just for the CEO, but for every mission-critical position on the executive team. That means advocating for robust performance reviews, identifying emerging internal talent, and building strong relationships with external recruiters.

The companies that lead in HealthTech tomorrow will be those whose Boards today are willing to rethink what leadership looks like—and invest in finding it, not just approving it.

Case Spotlight: Leadership That Scaled Medtech Innovation

One of NextGen’s stories involved a late-stage MedTech company transitioning from regulatory approval to commercial scale. Their original CEO—an engineer by training—was highly respected but lacked experience in market-facing roles.

Rather than risk stagnation, the Chairperson initiated a succession conversation and retained an executive search firm to identify a new CEO who could lead commercial strategy, attract global distribution partners, and communicate investor value.

The firm placed a CEO with a background in both Fortune 500 medical devices and high-growth healthtech startups. Within two quarters, the company doubled its pipeline, secured a strategic partnership with a European hospital group, and exceeded investor forecasts.

This wasn’t luck. It was leadership precision—matching company evolution with executive capability.

In industries where time-to-market defines valuation, having the wrong executive at the wrong time can be fatal. Retained recruiting transforms that risk into opportunity.

Investing In People Is Investing In The Future Of Care

HealthTech will continue to evolve. Technologies will come and go. Regulations will shift. Business models will adapt. But one truth will remain: companies don’t scale innovation—leaders do.

For CEOs, Boards, and Chairpersons looking to future-proof their organizations, Executive Search must move from reactive fill-in-the-gaps thinking to proactive leadership design. Recruiters must be more than vendors—they must be strategic allies.

Whether you’re preparing for succession, entering new markets, or scaling your product pipeline, your competitive edge won’t come from code. It will come from character, clarity, and conviction at the top.

The future of care depends on who leads it.

About NextGen Global Executive Search

NextGen Global Executive Search is a retained firm focused on elite executive placements for VC-backed, PE-owned, growth-stage companies and SMEs in complex sectors such as MedTech, IoT, Power Electronics, Robotics, Defense and Photonics. With deep industry relationships, succession planning expertise and a performance-first approach to recruiting, NextGen not only offers an industry-leading replacement guarantee, they also help CEOs and Boards future-proof their leadership teams for long-term success. They also specialize in confidentially representing executives in their next challenge.

www.NextGenExecSearch.com